|

🌍 Exciting News! 🌍 We're thrilled to host this thoughtful webinar on cross market opportunities between Africa, the Middle East, and Ireland! Have you ever thought about doing business across the different EMEA geographies? Or simply learn about the latest developments in markets such as Saudi Arabia, South Africa, and Nigeria? Come join us on the 19th of July, Friday, at 12pm Dublin/London/Lagos time for an hour of great conversation and networking! --Please share this with your network and anyone else who might be keen-- Our panel discussing the topic include: Eimear Costigan: Senior Market Adviser (Technology), Sub-Saharan Africa - Enterprise Ireland Emeka Chukwureh: Head Customer Flexibility Solutions - ENOWA, NEOM Akinwande Akinsulire: Head of Startup Support - Co-creation Hub (CcHUB) Cikay Richards: CEO of Lyra in Africa And will be moderated by: Leyla F Karaha: Techstars Community Leader and Founder of YourY Network | Social Entrepreneurs Edward Emmanuel: Founder of EE Digital Capital We look forward to seeing you on the 19th! -- Register to attend at https://lu.ma/otuobyoy -- 𝐈𝐟 𝐲𝐨𝐮'𝐯𝐞 𝐞𝐧𝐣𝐨𝐲𝐞𝐝 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞 𝐨𝐟 𝐜𝐨𝐧𝐭𝐞𝐧𝐭, 𝐥𝐞𝐚𝐯𝐞 𝐮𝐬 𝐚 𝐜𝐨𝐦𝐦𝐞𝐧𝐭, 𝐬𝐡𝐚𝐫𝐞 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞, 𝐨𝐫 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐨𝐮𝐫 𝐑𝐒𝐒 𝐟𝐞𝐞𝐝!

𝐏𝐥𝐞𝐚𝐬𝐞 𝐠𝐢𝐯𝐞 𝐮𝐬 𝐚 𝐟𝐨𝐥𝐥𝐨𝐰 𝐨𝐧 𝐬𝐨𝐜𝐢𝐚𝐥 𝐦𝐞𝐝𝐢𝐚 @ 𝐄𝐄 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐚𝐩𝐢𝐭𝐚𝐥

0 Comments

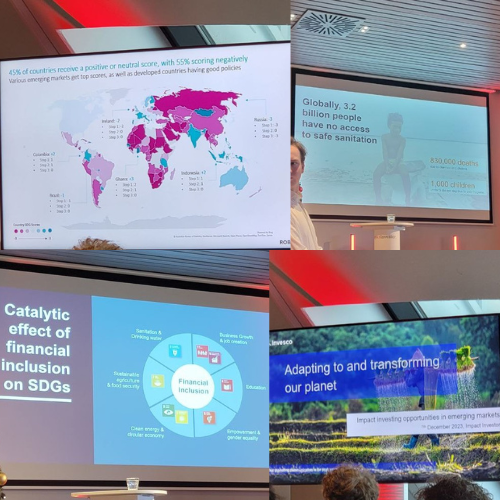

Last week's download on environmental and social impact was well worth the 5 back-to-back days! We covered everything from the latest regulatory and strategic opportunities in ESG, global benchmarks (Hello EU), regional developments, as well as compliance requirements and trends that could set up organisations / governments over 5, 10, 20 and 30 year timelines and beyond! The stand out highlights include opportunities around climate scenario analyses to carve out strategic ambitions, leveraging green bonds, loans, and sustainability linked notes for favourable finance, as well as Impact Asset Management in Africa and South East Asia! A big thank you to the workshop trainers and a special shout out to the awesome peer discussions we had throughout. More joining up the dots and positive change to come! 𝐈𝐟 𝐲𝐨𝐮'𝐯𝐞 𝐞𝐧𝐣𝐨𝐲𝐞𝐝 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞 𝐨𝐟 𝐜𝐨𝐧𝐭𝐞𝐧𝐭, 𝐥𝐞𝐚𝐯𝐞 𝐮𝐬 𝐚 𝐜𝐨𝐦𝐦𝐞𝐧𝐭, 𝐬𝐡𝐚𝐫𝐞 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞, 𝐨𝐫 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐨𝐮𝐫 𝐑𝐒𝐒 𝐟𝐞𝐞𝐝!

𝐏𝐥𝐞𝐚𝐬𝐞 𝐠𝐢𝐯𝐞 𝐮𝐬 𝐚 𝐟𝐨𝐥𝐥𝐨𝐰 𝐨𝐧 𝐬𝐨𝐜𝐢𝐚𝐥 𝐦𝐞𝐝𝐢𝐚 @ 𝐄𝐄 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 An insightful day of presentations and connections at this year's Impact Investor Conference! Connecting the dots on capital allocation into impact causes of people and planet, a reported USD 1 trillion was deployed in the preceding year. A record number! But the challenges have increased too.. Another note was how there was a disproportionate amount of capital that flowed into global north deals, compared to the global south and Least-Developed Countries (LDC). Interestingly, investment managers are now looking at different ways to categorise risk and opportunities in the global south, where asset manager Robeco came up with a '3-Step' scoring system that helped highlight the likes of Ghana and Indonesia among countries that scored well for emerging economy investment destinations. Sadly, Ireland got marked down in scoring for their apparent fuel subsidies! More work to be done (: Thanks to the organisers at FD Business/FD Mediagroup and all the other folks we connected with! 𝐈𝐟 𝐲𝐨𝐮'𝐯𝐞 𝐞𝐧𝐣𝐨𝐲𝐞𝐝 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞 𝐨𝐟 𝐜𝐨𝐧𝐭𝐞𝐧𝐭, 𝐥𝐞𝐚𝐯𝐞 𝐮𝐬 𝐚 𝐜𝐨𝐦𝐦𝐞𝐧𝐭, 𝐬𝐡𝐚𝐫𝐞 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞, 𝐨𝐫 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐨𝐮𝐫 𝐑𝐒𝐒 𝐟𝐞𝐞𝐝! 𝐏𝐥𝐞𝐚𝐬𝐞 𝐠𝐢𝐯𝐞 𝐮𝐬 𝐚 𝐟𝐨𝐥𝐥𝐨𝐰 𝐨𝐧 𝐬𝐨𝐜𝐢𝐚𝐥 𝐦𝐞𝐝𝐢𝐚 @ 𝐄𝐄 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 We've been asked a lot about the best times to raise funds and what investors look for 💰 And very related to this, are the 3 core 'fits' that a new technology company has to meet, before becoming a thriving, profitable business. Plenty of young companies make good inroads when it comes to determining the first stage of Problem-Solution fit, but struggle at the second stage. Product-Market fit 🧩 In fact, many companies fail because they don't reach 'PMF' within their runway. But what does it actually mean? It means to have a proposition product or service that very much meets the needs of a specific and narrowed customer segment. This customer segment should be pinpointed in terms of their sector, industry, job roles, responsibilities, pains faced, and other 'stuff' they're trying to get done. Paying attention to the latter bits, we want to solve the very human-centric challenges faced by the personas in that customer segment. Two key points to this. Product-Market fit is found when: 👉There is consistent demand forming with that customer segment. i.e. you see the same level of engagement and appetite from other customers that match the analysis of the chosen customer segment 👉That customer segment is paying for the solution, even if it's a prototype/MVP and not a full product release. This is the ultimate indicator. But if they are not paying for the prototype, you should have very strong evidence they'd be willing to pay for it. With enough of these two points as evidence, you'll have a much better vantage point of raising seed money, and even graduating to growth money. But we'll save the conversation on growth and the third stage of Business-Model fit for next time. What has your experience been with trying to reach Product-Market fit? 𝐈𝐟 𝐲𝐨𝐮'𝐯𝐞 𝐞𝐧𝐣𝐨𝐲𝐞𝐝 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞 𝐨𝐟 𝐜𝐨𝐧𝐭𝐞𝐧𝐭, 𝐥𝐞𝐚𝐯𝐞 𝐮𝐬 𝐚 𝐜𝐨𝐦𝐦𝐞𝐧𝐭, 𝐬𝐡𝐚𝐫𝐞 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞, 𝐨𝐫 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐨𝐮𝐫 𝐑𝐒𝐒 𝐟𝐞𝐞𝐝! 𝐏𝐥𝐞𝐚𝐬𝐞 𝐠𝐢𝐯𝐞 𝐮𝐬 𝐚 𝐟𝐨𝐥𝐥𝐨𝐰 𝐨𝐧 𝐬𝐨𝐜𝐢𝐚𝐥 𝐦𝐞𝐝𝐢𝐚 @ 𝐄𝐄 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 |

ArticlesUseful content to navigate the landscapes of innovation and disruption Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed