|

Happy Earth Day 2024! 🌍 The coming years are critical in setting the tone for the future of our planet. We've got some ambitious targets to meet by the end of the decade, leading up to our make or break 2050 milestone. At the same time, some exciting opportunities lie at the precipice. Such as fully harnessing market forces to enable our global carbon sinks. Supercharging new forms of sustainable energy in solar, wind, hydrogen, and others. Eliminating our reliance on single use plastic, and plenty more. Let's take a moment to think about how we, in our individual and organisational capacities, can further contribute to the cause. And what better way than to start on this very day! 𝐈𝐟 𝐲𝐨𝐮'𝐯𝐞 𝐞𝐧𝐣𝐨𝐲𝐞𝐝 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞 𝐨𝐟 𝐜𝐨𝐧𝐭𝐞𝐧𝐭, 𝐥𝐞𝐚𝐯𝐞 𝐮𝐬 𝐚 𝐜𝐨𝐦𝐦𝐞𝐧𝐭, 𝐬𝐡𝐚𝐫𝐞 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞, 𝐨𝐫 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐨𝐮𝐫 𝐑𝐒𝐒 𝐟𝐞𝐞𝐝!

𝐏𝐥𝐞𝐚𝐬𝐞 𝐠𝐢𝐯𝐞 𝐮𝐬 𝐚 𝐟𝐨𝐥𝐥𝐨𝐰 𝐨𝐧 𝐬𝐨𝐜𝐢𝐚𝐥 𝐦𝐞𝐝𝐢𝐚 @ 𝐄𝐄 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐚𝐩𝐢𝐭𝐚𝐥

0 Comments

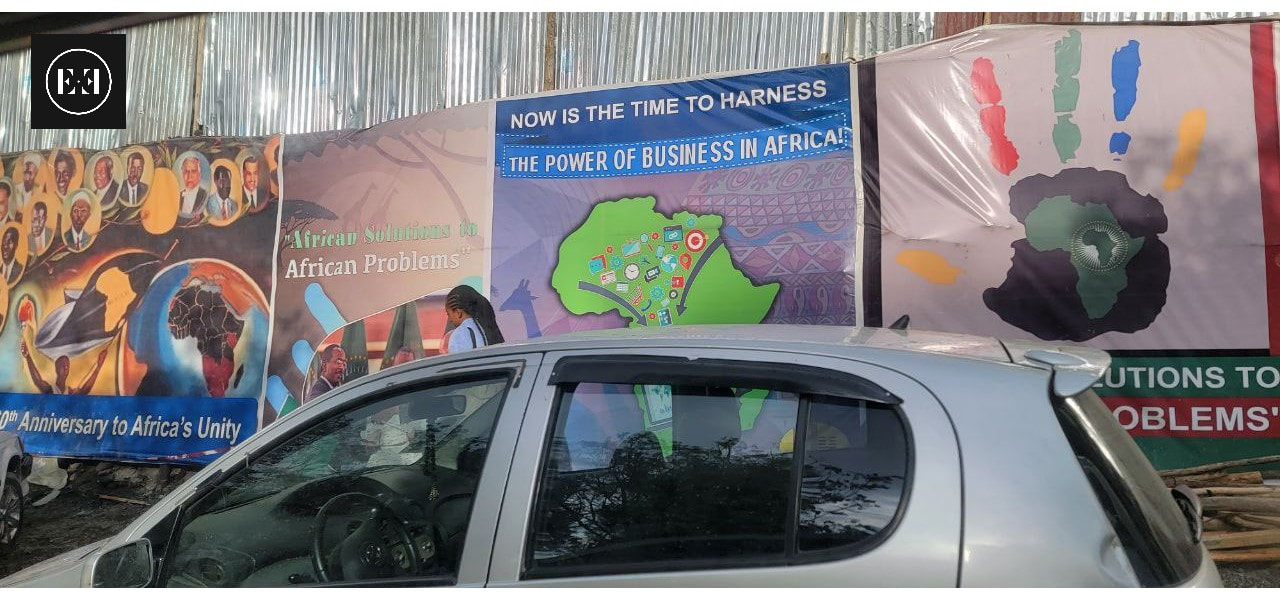

Despite robust economic growth, Africa🌍 is grappling with a significant issue: its prosperity isn't being evenly distributed 💰👪🏾 Financial inclusion, which is the ability to access and utilise formal financial services effectively, can be a key enabler to this! According to the latest World Bank Development Economics Data, Sub-Saharan Africa has 33% of adults owning mobile money accounts, compared to 10% globally, but only 55% of adults in the region have any form of non-cash remittance financial access. Though this rose by 12% in the past six years, nearly half the adult population (45%) still lacks access to any essential financial services. This is below the 71% average for other developing regions 💱 The gender gap is particularly striking.. Only 49% of women have access to financial services compared to 61% of men. This disparity is often due to limited access to mobile phones and identification documents, which are crucial for setting up and using financial accounts 📱👩🏾💼 When it comes to savings, the data reveals more 😲 39% of mobile money users actively save using their accounts, but overall saving rates in the region is only 56%. Meaning a whopping 44% lack access to any sort of savings instrument. Moreover, only 14% of adults can access $50 in emergency funds in 30 days should their main income source get disrupted! But it's not all bleak. The rapid adoption of digital wallets and mobile money offers a promising pathway for broader financial inclusion. With easier and cheaper access to smartphone data plans, digital wallets are becoming a mainstream solution for financial transactions - think direct peer to peer exchange + micro savings/loans etc. The expansion of digital wallets, as seen with M-Pesa in Kenya, demonstrates the transformative impact these tools can have. By 2025, digital wallets in Africa are expected to generate $15 billion in revenue, growing at a compound annual growth rate of 24% 📈 🚀 But addressing underlying barriers such as the gender gap, digital literacy, enabling affordable data plans, and connecting existing eco-systems and stakeholders on the ground - is a must! Drawing lessons from other developing regions, Brazil's experience with its Pix (Banco Central do Brasil) payment system helped increase financial account ownership from 56% in 2011 to 84% today. Developing an inclusive digital finance ecosystem, fostering a pro-competition environment, and deepening collaboration between incumbent financial institutions and fintech startups are crucial from our Latin American and Asian examples 🇧🇷 🌎 With inclusive financial practices, we can empower individuals and businesses across Africa to participate fully in their economic upside and drive sustainable resilient growth. Are you involved in the space and trying to make a difference? Give us your take on financial inclusion and Africa's rise! 𝐈𝐟 𝐲𝐨𝐮'𝐯𝐞 𝐞𝐧𝐣𝐨𝐲𝐞𝐝 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞 𝐨𝐟 𝐜𝐨𝐧𝐭𝐞𝐧𝐭, 𝐥𝐞𝐚𝐯𝐞 𝐮𝐬 𝐚 𝐜𝐨𝐦𝐦𝐞𝐧𝐭, 𝐬𝐡𝐚𝐫𝐞 𝐭𝐡𝐢𝐬 𝐩𝐢𝐞𝐜𝐞, 𝐨𝐫 𝐬𝐮𝐛𝐬𝐜𝐫𝐢𝐛𝐞 𝐭𝐨 𝐨𝐮𝐫 𝐑𝐒𝐒 𝐟𝐞𝐞𝐝!

𝐏𝐥𝐞𝐚𝐬𝐞 𝐠𝐢𝐯𝐞 𝐮𝐬 𝐚 𝐟𝐨𝐥𝐥𝐨𝐰 𝐨𝐧 𝐬𝐨𝐜𝐢𝐚𝐥 𝐦𝐞𝐝𝐢𝐚 @ 𝐄𝐄 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 |

ArticlesUseful content to navigate the landscapes of innovation and disruption Archives

July 2024

Categories

All

|

RSS Feed

RSS Feed